How Afterpay works for in-person payments

It’s simple to accept in-person payments using Afterpay

It’s simple to accept in-person payments using Afterpay.

ready to accept afterpay payments

in person for your business?

ready to accept afterpay payments in person for your business?

It's easy for customers to pay with Afterpay, and it's just as simple for you to process Afterpay transactions.

On this page you’ll find everything you need to know about accepting Afterpay payments in person – bringing you one step closer to reaching more customers and driving more sales.

How to accept

in-person Afterpay payments

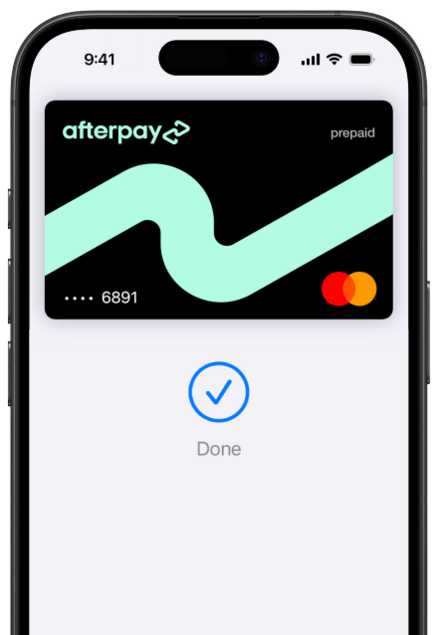

To pay with Afterpay in person, customers need the Afterpay Card. This is a contactless digital card stored in the digital wallet of the customer’s phone. The customer adds their Afterpay Card to their digital wallet via a one-time setup process in their Afterpay app.

Discover how in-store

payments work

Discover how

in-store payments

work

Watch this video to learn more about processing payments in person with Afterpay.

How to process a payment with Afterpay Card

how afterpay works for customers

It's simple. The Afterpay Card is powered by Mastercard in Australia and by Visa in New Zealand.

You process the transaction like you normally would, and your customer taps their Afterpay Card to pay.

It's simple. The Afterpay Card is powered by Mastercard in Australia and by Visa in New Zealand. You process the transaction like you normally would, and your customer taps their Afterpay Card to pay.

STEP 1

You process the transaction like any other card payment on your point-of-sale (POS).

STEP 2

Your customer taps their Afterpay Card (from their phone) on your payment terminal to pay.

STEP 3

That’s it. You’re paid upfront by Afterpay, while your customer pays it in 4 interest-free instalments.

TIP

Because you receive the full sale amount upfront (even if your customers pay in instalments), it’s important that you process the full sale amount through your POS system.

STEP 4

Afterpay will direct debit your business the Afterpay fee owned for the transaction within 3 business days.

TIP

You can log in to the Afterpay Business Hub to keep track of Afterpay orders and payments at any time.

When will I receive funds?

You receive the funds at the time of purchase via your service provider, less any processing fees. Afterpay then takes a percentage of the sale as a fee which will be direct debited from your nominated bank account.

How do I process an

in-person refund?

You process Afterpay refunds the same way as you’d normally process a card refund.

Step 1

Confirm that the original purchase was made with Afterpay.

Step 2

Process the return as you normally would through your POS, following your business’ returns policy. Ensure you refund the full amount (regardless of how many payments the customer has made to Afterpay).

Step 3

Once this prompts your payment terminal, the customer taps their Afterpay Card to complete the refund.

Step 4

The refund is complete. The customer will receive the refund within a few business days and any remaining payments will be cancelled. For you, the refund will be accounted for in your next settlement.

processing refunds

Watch this video to learn more about processing Aferpay refunds in person.

FAQs

How do I process an in-person refund?

It’s simple. You process Afterpay refunds the same way as you’d normally process a card refund.

- Confirm the original purchase was made with Afterpay (see the below instructions under "How can I check that the customer originally paid with the Afterpay Card").

- Process the refund through your POS system as you normally would, following your business’ returns policy. Be sure to refund the full amount (regardless of how many payments the customer has made to Afterpay).

- Once this prompts your eftpos terminal, the customer taps their Afterpay Card to complete the refund.

- That’s it. The customer will receive the refund within a few business days, and any remaining payments will be cancelled. Your refund will be reflected in your next settlement.

When will I receive funds?

You receive the funds at the time of purchase via your service provider, less any processing fees. Afterpay then takes a percentage of the sale as a fee which will be direct debited from your nominated bank account.

How can I check that the customer originally paid with the Afterpay Card?

Your customer’s receipt will show the payment method as Mastercard in Australia and Visa in New Zealand. You can then match the last four card digits listed on the receipt to the Afterpay Card device number via the steps below. This is the same process you would use to match any digital card number to the receipt.

Apple devices

- Open the Wallet app and tap the Afterpay Card.

- Click the three dots followed by the Apple Card Number.

- Find the four digits listed under Apple Pay.

Android devices

- Open the Google/Samsung Wallet and tap the Afterpay Card.

- Tap the three dots to find the four digits listed under ‘Virtual account number.’

What if the customer accidentally provides a different payment method for the return?

Does your customer need help? They can contact Afterpay’s customer service team via the help section of the Afterpay app or by filling out this form online.

What about partial refunds?

If there is a partial refund applicable, process the return in the same way as outlined above under "How do I process an in-person refund?”

Can I process an online refund in-person?

If your business accepts refunds for online orders in person, you process the refund or exchange as you normally would.

What about exchanges?

If your policy allows it, initiate the exchange via your POS following your usual process. Then, if there is a partial refund applicable, process the return in the same way as outlined above. However, if the customer owes a difference in cost, process the remainder of the sale in the same way as your usual sales process, via any tender type.

What happens when customers don’t have the Afterpay Card?

Customers need the Afterpay Card to purchase in person. To get the Afterpay Card, they simply download the Afterpay app from their device’s app store.

Contact our friendly Business Support team

Yes of course – we don't want you to miss out on sales! You and your team can contact our friendly Customer Service team via phone:

AUSTRALIA 1300 621 603 09:00-17:00 AEST/AEDT

NEW ZEALAND 0800 472 317 11:00-19:00 NZST/NZTD

If your customers need support? They can contact our Customer Service team via the 'Help' button within their Afterpay app.

View more

Working in a customer-facing role and looking for more info and FAQs on the Afterpay Card?

Read our easy-to-use Afterpay Guide.