Get more out of Afterpay.

Enhance

your Afterpay

experience.

Be the boss of your payments with our latest features. Watch our video to find out more, plus hear about credit checks and reporting being introduced from 23 July 2024 as part of our industry obligations.

Start with the basics.

Pay it in 4, in-store.

Enjoy all the perks of Afterpay in person. Add the Afterpay Card to your digital wallet via the app, shop in-store then pay over 6 weeks.

Set up now

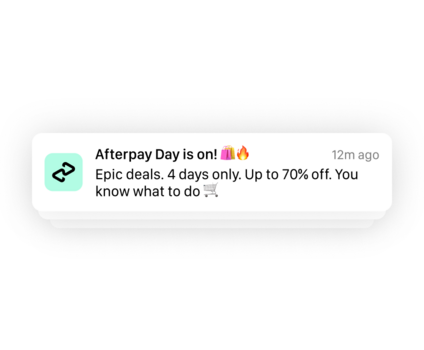

Catch a deal with the app.

Use the Afterpay app to find the best deals and exclusive offers from top brands. Turn on your notifications so you don’t miss a thing.

Save it. Label it. Plan it.

Tap the heart to save, list and organise all your favourite products. Plan a budget before you check out by tapping $ and get a breakdown of the payments due.

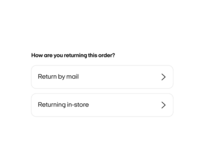

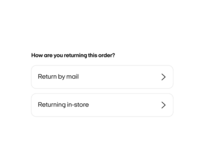

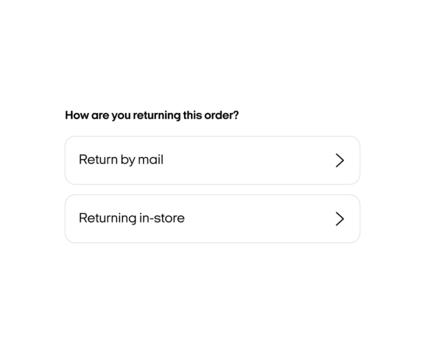

Don’t sweat the returns.

Start your return directly with the store, then once the store notifies us, we’ll refund you, starting with your final payment and working backwards. Log your return in the app to pause any future payments.

Find out more

Manage your money with confidence.

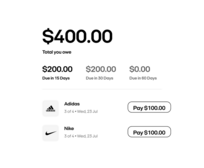

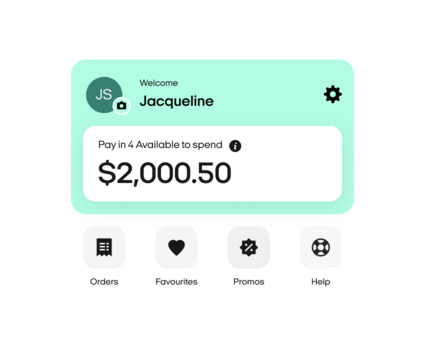

Keep tabs on your orders & payments.

Check your spend limit and orders in the My Afterpay tab. Stay on top of payments by turning on notifications so we can send you reminders.

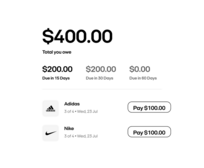

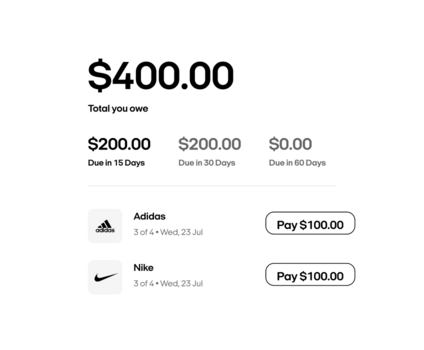

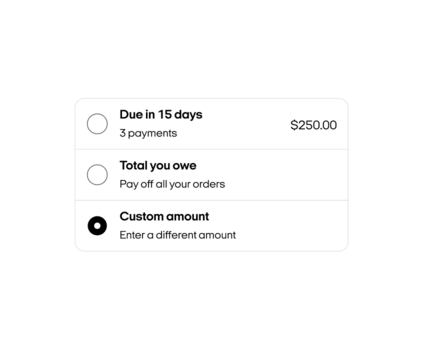

Make multiple payments with one tap.

You can choose to pay early, pay multiple orders at once, or pay the entire remaining balance.

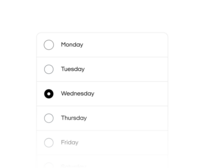

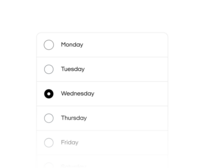

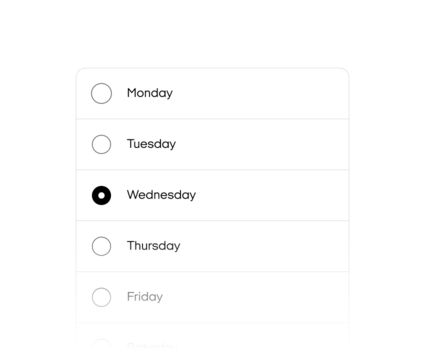

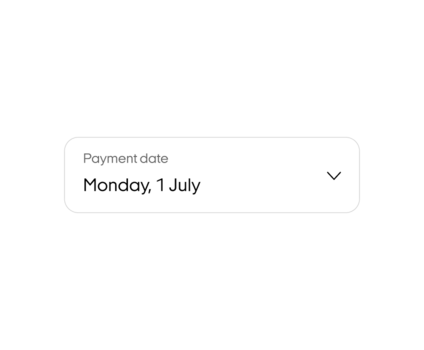

Fit payments to your schedule.

Schedule your payments to a day of the week that suits you. Pick your day in Payment settings in the app. Applies to future orders only.

Wiggle room when you need it.

Reschedule your next payment by a week if you need; you can do this up to three times a year. It’s important to note that some payments can’t be changed though.

Find out more

Need help to keep up?

We’re here to help. If you’re experiencing financial hardship, you should contact us as soon as possible to discuss your options.

Find out more

More perks.

Been with us for a while and have a good track record of consistent on-time payments?

Then these benefits are for you.

Been with us for a while and have a good track record of consistent on-time payments? Then these benefits are for you.

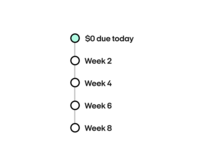

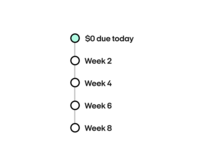

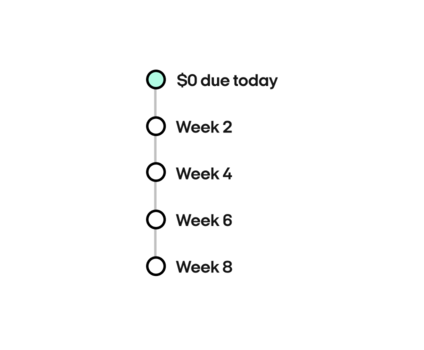

Get more time to pay.

Delay your first payment by up to two weeks with our ‘no payment upfront’ feature. That’s right, pay $0 upfront on eligible purchases under $500, excluding gift cards. Access is dependent on a range of factors - we’ll notify you if you’re eligible.

The gift of choice. The luxury of time.

Eligible customers can pay it in 4 across a wide range of gift cards delivered straight to their inbox.#

Find out more

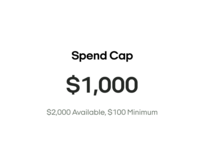

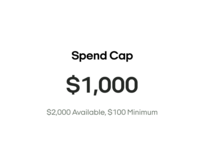

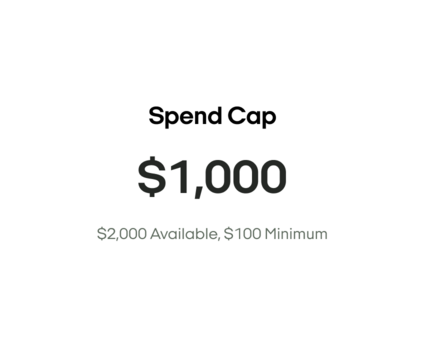

Increase your spend limit.

Still have questions?

Do I have to download the Afterpay app to use Afterpay in-store?

Is there a minimum spend for in-store Afterpay purchases? Is there a maximum spend?

What are the benefits of choosing a payment day?

If I change my mind, can I cancel my preferred payment day?

Is there a limit on changing my preferred payment day?

Can I reschedule a payment on an existing order?

- You can only move one payment per order. If you need more help, please send us a message via the app.

- You will not be able to reschedule the first or last payments via this self-service feature, if you require help with this, please send us a message via the app.

- If a payment is already overdue or due within the next 24 hours, we cannot move the payment (neither our team or by using the self-service feature).

- Brand new customers (less than 42 days since your first purchase) will not be able to use this feature.

- If you are already under a hardship repayment arrangement with us, you will not have access to this feature.

I’ve already used up my 3 self-service reschedules for the year, but need to move more, what can I do?

What is ‘no payment upfront’ and how does it work?

Received a notification at the checkout that there’s $0 due on the purchase date? Congratulations! This means that you have access to our ‘no payment upfront’ feature.

Your first payment will be due 8–14 days after your purchase date, aligned to your preferred payment day.

Access is determined by a range of factors including payment history, shopping frequency and how long you’ve been with Afterpay.

Certain purchases don’t qualify for ‘no payment upfront:

- Gift cards

- Orders over $500

- Purchases from grocery or fuel merchants. This includes supermarkets and similar businesses, petrol stations, and some convenience stores.

I no longer have access to the ‘no payment upfront’ feature - why?

If you previously had access to the ‘no payment upfront’ feature and have missed some payments on your account, or haven’t used Afterpay in a while, this will result in the feature being deactivated. We may also deactivate the feature in accordance with the Afterpay Terms of Service.

The good news? We review access regularly. Keep using Afterpay, stay on top of your payments and we might have good news for you soon. Be sure to have your app updated and your notifications enabled.

I no longer have access to the ‘no payment upfront’ feature - why?

If you previously had access to the ‘no payment upfront’ feature and have missed some payments on your account, or haven’t used Afterpay in a while, this will result in the feature being deactivated. We may also deactivate the feature in accordance with the Afterpay Terms of Service.

The good news? We review access regularly. Keep using Afterpay, stay on top of your payments and we might have good news for you soon. Be sure to have your app updated and your notifications enabled.

What is a credit check?

Why does Afterpay perform credit checks?

What is a credit report?

- Website: centrix.co.nz

- Email: helpdesk@centrix.co.nz

- Phone: 0800 836 274

- Mail: PO Box 62512, Greenlane, Auckland 1546

What information is being reported to credit bureaus?

What is a credit score?

If I have a bad credit score, will I be allowed to use Afterpay?

What if I don’t consent to performing credit checks and credit reporting? Will I still be able to use Afterpay?

Can I buy gift cards from Afterpay?

Why is my purchase of Gift Cards declining?

How can I increase my spend limit?

- On-time payment history.

- How long you’ve been with Afterpay.

- Any declined orders or payments.

- The information contained in your credit report.

Do I have to download the Afterpay app to use Afterpay in-store?

Is there a minimum spend for in-store Afterpay purchases? Is there a maximum spend?

What are the benefits of choosing a payment day?

If I change my mind, can I cancel my preferred payment day?

Is there a limit on changing my preferred payment day?

Can I reschedule a payment on an existing order?

- You can only move one payment per order. If you need more help, please send us a message via the app.

- You will not be able to reschedule the first or last payments via this self-service feature, if you require help with this, please send us a message via the app.

- If a payment is already overdue or due within the next 24 hours, we cannot move the payment (neither our team or by using the self-service feature).

- Brand new customers (less than 42 days since your first purchase) will not be able to use this feature.

- If you are already under a hardship repayment arrangement with us, you will not have access to this feature.

I’ve already used up my 3 self-service reschedules for the year, but need to move more, what can I do?

What is ‘no payment upfront’ and how does it work?

Received a notification at the checkout that there’s $0 due on the purchase date? Congratulations! This means that you have access to our ‘no payment upfront’ feature.

Your first payment will be due 8–14 days after your purchase date, aligned to your preferred payment day.

Access is determined by a range of factors including payment history, shopping frequency and how long you’ve been with Afterpay.

Certain purchases don’t qualify for ‘no payment upfront:

- Gift cards

- Orders over $500

- Purchases from grocery or fuel merchants. This includes supermarkets and similar businesses, petrol stations, and some convenience stores.

I no longer have access to the ‘No payment upfront’ feature - why?

What is a credit check?

Credit checks are when lenders review a customer’s credit report to gauge how reliable they are when it comes to managing credit.

At Afterpay, we conduct credit checks to evaluate new customers' applications and to determine if a spend limit increase is appropriate. These checks help us make informed decisions while ensuring responsible lending practices.

The credit check we perform when you join may be visible to other lenders and may impact your credit score.

In contrast, the credit checks we perform during spend limit increase assessments are not visible to other lenders and do not impact your credit score.

Why does Afterpay perform credit checks?

What is a credit report?

What information is being reported to credit bureaus?

What is a credit score?

If I have a bad credit score, will I be allowed to use Afterpay?

- Website: centrix.co.nz

- Email: helpdesk@centrix.co.nz

- Phone: 0800 836 274

- Mail: PO Box 62512, Greenlane, Auckland 1546

What if I don’t consent to performing credit checks and credit reporting? Will I still be able to use Afterpay?

Can I buy Gift cards from Afterpay?

Why is my purchase of gift cards declining?

How do I contact Afterpay?

The quickest way to get answers is by browsing our Help articles, where you’ll find solutions to most questions.

If you need further assistance, the best way to reach us is by messaging through the Help section of your Afterpay app — this is the fastest and most convenient option.

Need to speak with someone? You can also request a callback there, and our team will call you back during phone support hours.

If you do not have the Afterpay app, you can complete a contact form here.

Please note that our offices are closed on Good Friday and Christmas Day.

How do I contact Afterpay?

The quickest way to get answers is by browsing our Help articles, where you’ll find solutions to most questions.

If you need further assistance, the best way to reach us is by messaging through the Help section of your Afterpay app — this is the fastest and most convenient option.

Need to speak with someone? You can also request a callback there, and our team will call you back during phone support hours.

If you do not have the Afterpay app, you can complete a contact form here.

Please note that our offices are closed on Good Friday and Christmas Day.

Want to know more?

Check out our How Afterpay Works page, or head to our Help centre.