Managing money and monitoring cashflow might not be the glamorous side of your business, but in today’s climate it’s something businesses are hyper-aware of.

In support of this, Afterpay is making changes to the way we process your direct debits, when you have a negative balance, so that you can better manage your cash flow and working capital.

Why would I have a negative balance?

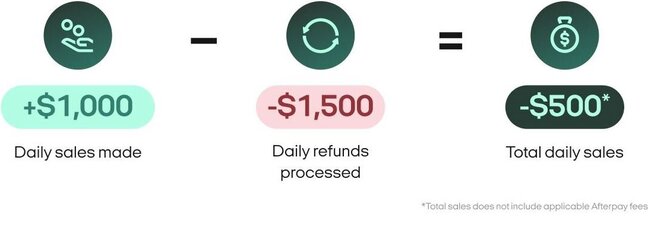

When a customer’s order is refunded, and they selected Afterpay as their checkout method, that refund amount is displayed as a negative balance. This negative balance will remain when you have a higher dollar amount in a day than of your total orders.

Example of a positive balance

Example of a negative balance

So what's changing?

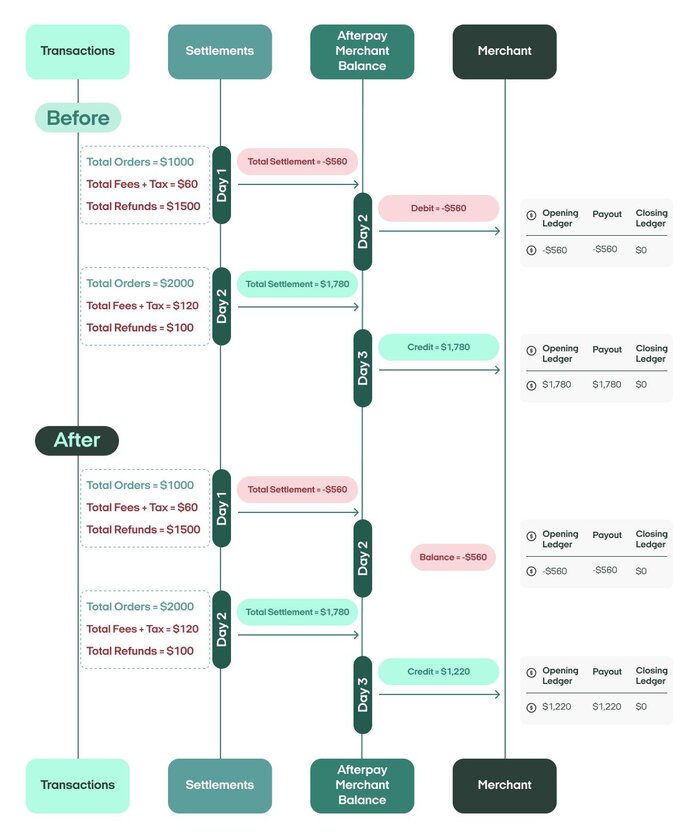

Historically when you had a negative balance, Afterpay would send you an invoice or direct debit you. From today, we’ll apply any negative balances against your future orders. All negative balances will be rolled into future payments unless it goes beyond certain thresholds / limits, giving you more time to offset these, and avoid an ongoing negative balance.

Long-standing negative balances.

If your negative balance extends beyond certain thresholds / limits, we reserve the right to collect your payments via invoices or direct debit attempts.

Have any questions on this product update? Reach out to our Merchant Support team below.

All references to any registered trademarks are the property of their respective owners. Afterpay does not endorse or recommend any one particular supplier and the information provided is for educational purposes only.

Categories